The Market Failure

Enterprises in developing countries with great business concepts and initial regional success frequently falter compared with similar companies in more developed countries. This is due to more limited access to capital to support operations and growth beyond the borders of their home country; lack of investor money results in firms unable to capture new market opportunities, failing to grow to their full potential with investors labelling enterprises and their countries as sub-standard–– a falsehood.

A self-fulfilling prophecy ensues; these firms’ growth rates and valuation make it difficult to attract the venture capital (VC) or private equity (PE) investment needed to achieve what they are capable of.

Financing Underserved and Underfinanced Enterprises

We at Innovative Ventures serve international organizations to break this cycle. We create a supportable investment structure along with managing investment funds that solve these issues––to create a viable funding environment to ensure international growth and success for companies in your country.

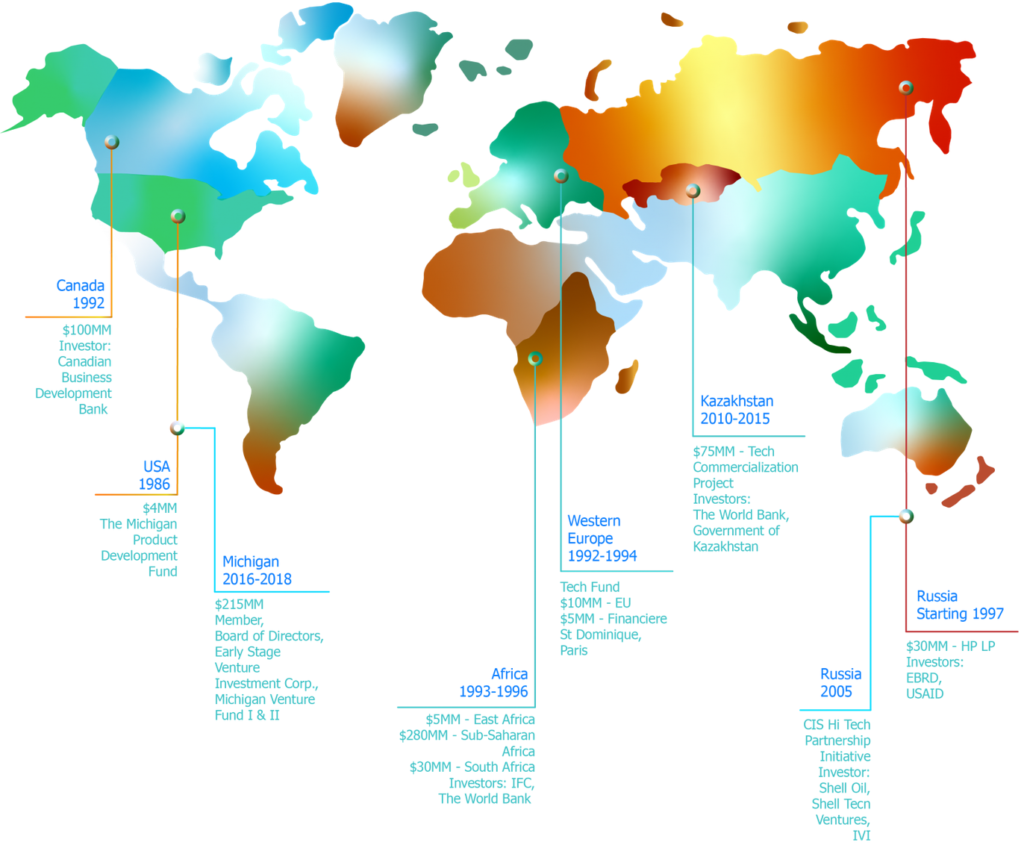

Multi-asset funds we created to resolve demand/supply imbalances for capital, by example include:

Fund-of-Funds: Africa, 1994, $5MM

Venture Debt: Canada, 1992, C$100MM; Sub-Sahara Africa, 1993, $280MM

Royalty/Cash Flow: US, 1986, $4MM; France/Germany, 1992 $5MM; Europe, 1994, $10MM

VC/PE: South Africa, 1996 $30MM; Russia, 1997 $32MM

Corporate VC: Russia, 2005 $5MM

Innovation Grants: Kazakhstan, 2010 $75MM

Our clients and investors include governments, their sovereign wealth funds, development finance institutions and institutional investors.

“Underserved and Underfinanced Enterprises: Who Are They Exactly?”

They fall into three categories:

- Medium growth enterprises with strong cash flow, yet, due to limitations in their home country, they are unable to attain the hockey stick growth required to interest VC.

- Family-held enterprises, even those with rapid growth, that reject investor interest because they resist involvement of outsiders and capital from non-family members

- Enterprises in countries with less-than-efficient capital markets that make it more difficult to access investment. Companies from capital-constrained countries must be bigger and more profitable to attract equivalent investment. Until these firms achieve scale and prove success, liquidity is more difficult to demonstrate, resulting in financing needs which remain unfilled.

More Capital is a Solution to Market Failures Too

Our multi-asset funds don’t just satisfy companies’ demands for capital, our solutions increase the supply of capital too. We overcome the structural limitations of traditional VC/PE approaches by creating hybrid fund strategies and deal structures which:

Better manage the ROI-to-risk uncertainties in VC investment (i.e., fund success requires 2 unicorns compensating for the write-offs and investments that return less-than-invested capital in a portfolio of 10 investments).

Access new capital/investors to advance technology adoption and purchase in new ways, for example cost savings from advanced manufacturing provides return of capital and profit for subsidizing customer purchases.

Attract new institutional investors by eliminating barriers to investment. As one example, royalty based funds are a better match to the liquidity and risk criteria of some institutional investors vs. VC or PE funds.

Steps to Create New Funds

“Let’s Map Demand”

We investigate and evaluate a select number of companies in the target region. Next we take a macro view to determine which segments, industries, and enterprise niches provide the highest potential for investment success and what objectives can be achieved with a new fund.

We also evaluate customers––quality and quantity. Low-population countries frequently have too few customers to generate meaningful scale, disqualifying them for investment. Our team investigates whether management teams see expansion to neighboring countries as viable, for example entry to neighboring countries, to East/West Europe, North America, China or other––how viable is their strategy, can the management team execute successfully?

“What’s Lacking in Supply?”

Next we assess the sources of capital to finance demand from companies: where do mismatches exist between demand for and supply of capital; what are the gaps that exist, why and which spaces need to be filled with which strategy and deal structure?

“Whoa, Not So Fast! Capitalizing a Fund Requires Other Steps Too”

Lastly, we create the documents for fund raising to commence. These include not only the private placement memorandum which details the fund strategy/structure, gaps to finance, target deal sizes, life/size of fund ($ AUM) and legal jurisdiction, but also the request-for-proposal, e.g., fund management tender documents and contracts––harmonized to both international and local legislation.

Ensuring Fund Success

Simply establishing a fund does not go far enough to ensure the success of the fund and the enterprises that comprise a fund’s portfolio. Innovative Ventures builds new capabilities in investee funds of institutional investors to improve their operating effectiveness and efficiencies. This includes not only increasing the effectiveness of each individual activity, but also improving the interactions between activities and creating positive impact from working together such as:

- Team Formation and Foundational Skills

- Governance/Policies and Procedures/Documentation

- Funding and Investor Relations with Limited Partners (LPs)

- Portfolio Management

- Liquidity and Management of Foreign Exchange

- Impact and ESG Management, UN Sustainable Development Goals (SDGs)

Our Successes

The true test of an advisor is the results it achieves for its investors, clients, partners, investee companies and itself.

Listed here are funds we created, and those co-managed with others. Each link takes you to a summary of the market failure solved by our funds.

USA: Improve Long-Term Investment Returns $4MM AUM

Russia: Build Staff Skills in Emerging Market VC $32MM and $440MM AUM

Russia: Attract Corporate Venture Capital as the Early Adopters of Technology $5MM

Canada: Increase the Supply of Capital and Improve Total Returns $C100MM AUM

Croatia: Increase the Supply of Capital to Finance Tech and SMEs €20MM AUM

W. Europe: Eliminate Waste and Learning Curve Costs $5MM AUM

East Africa: Catalyze Investment into Emerging Markets $5MM AUM

Kazakhstan: Develop Emerging Markets for Private Sector Investment

Kazakhstan: Make Technology ‘Customer and Investor’ Ready $75MM AUM

South Africa: Invest in a Country’s Economic Restructuring $30MM AUM

France/Germany: Increase Market Share thru Quasi-Equity $5MM AUM

Sub-Sahara Africa: Implement Strategies for Emerging Market VC $280MM AUM

“Consider IVI as your investment advisor and partner in planning and executing new investment schemes. We can help you avoid the learning costs that even skilled investors inadvertently incur when executing new investment programs.”