In Part V, subjects discussed:

1.) For Entrepreneurs—What are You Selling to Investors?

2.) For Investors—Let’s Be Realistic

3.) For Governments/Development Finance Institutions—Atypical Leadership Needed

4.) Concluding Remarks

5.) My Next Blog Series—Mobilize Local Capital to Finance Your Dreams

6.) About Me

7.) Links: Evolution of Runet (Russia Internet) & the Russia Tech Scene

Last time in Part IV, the Quest for Growth, I discussed:

1.) Clonentrepreneurship or Alternative Paths to the Start-up of Start-up Communities?

2.) Change the Culture & Amazing Things Happen

Read Part IV here.

The ‘take-away from Part IV.

Clonentrepreneurs sensitize local investors to the rewards of investing in technology since clones match the behavior of local investors to risk. As results are achieved and money is made by all, investors open up to new investment opportunities a bit more adventuresome and innovative—disruptive vs. cloning.

Cloning and Clonentrepreneurship is one strategy to impact the DNA of local investors in emerging countries to spark the startup of start-up communities, but of course others exist.

What are the other actions which each you can take to achieve your objectives and fuel the startup of start-up communities?

For Entrepreneurs—What Are You Selling to Investors?

Entrepreneurs raising money too often attempt to shape investor risk behavior to their investment opportunity. Instead, shape your business model to match the needs of not only your customers but investors too. Think creatively to find the solution which your customers will pay for—no matter how little the revenue is per customer—to craft your business model to match investors’ DNA to risk. Design your business model and its execution to systematically attack each of their fears to early stage tech deals.

Once you have this business model executed with paying customers, approach investors by ‘selling risk, then opportunity,’ i.e., demonstrate how you’ve eliminated risk in each of the four categories to prove your great investment opportunity. Once you raise money, execute yes but also pay forward in your start-up community; be the role model to other entrepreneurs, teach/mentor them in the solutions which you executed to overcome the fears of local investors in emerging markets.

For Local Investors—Let’s Be Realistic

Rarely will Western clones match the big returns as your investments in telecomm, real estate, construction, food/beverages, fast moving consumer goods, wholesaling and retailing have performed. Yet as the economy in your country progresses and incomes grow, populations and enterprises open their pocketbooks to products and services which better match changing needs.

In the Chinese online travel industry for example, Ctrip and eLong have millions of registered users. Entrepreneurs seeking money to compete against them is risky and uncertain; however opportunities exist for unorthodox business models. For example, Chinese company Qunar is a travel search engine for online travel services. It aggregates travel information like air tickets, hotels and holiday offerings so Chinese consumers can make better and more informed travel decisions. Qunar serves the evolving needs of consumers and achieves success by approaching the market differently by making competitors—its partners.

Tell entrepreneurs your needs for business models which generate revenues in the immediate term; postpone your demands for immediate profits and cash distributions. Be creative in deal structuring and flexible to valuations since tech business models scale better across customers and geographies to justify higher prices paid vs. investments in brick and mortar.

Structure the investment agreement to align and incentivize entrepreneurs to your attitudes and behaviors to risk. Oh, how does that work? An example:

American investor financings typically include an equity option plan for founders and employees. In some emerging countries, legislation permits the issuing of equity options to management of start-ups. When permissible, distribute equity shares based on revenues realized vs. traditional metrics like length of time served in the company or # of users engaged. If legislation does not permit this action, structure the investment agreement as equity earn-ins held in escrow with shares issued when agreed-upon metrics are achieved.

For Governments/Development Finance Institutions—Atypical Leadership Needed

Governments and their finance institutions conceive venture initiatives to catalyze venture funds, to finance the startup of start-up communities. Frequently these funds are modeled to the program called Yozma, the Israel Government’s fund-of?funds.

Yozma was capitalized with $100 million; $80 million which financed new VC funds with $20 million for direct investment into Israeli tech SMEs. It invested $8 million into a private VC fund with a minimum of $12 million/fund invested by Israeli and foreign venture capitalists. Yozma financed ten VC funds with a total capitalization exceeding $200 million. These funds went on to finance innovative companies and spur the development of the high tech SME and VC industry in Israel, where one did not exist before. Fast forward 10 years and the 10 funds supported by Yozma were managing over $3+billion with the VC industry in Israel managing $10+billion.

Yozma-type schemes offer economic incentives to induce investment and build learning experiences in seed and early stage tech investing such as:

1.) Commit up to 49% of the capital to the creation of a new VC fund

2.) Offer preferential returns to investors

3.) Take 1st losses on failed investments

4.) Cap financial returns to the Government so as to boost profits to investors

5.) Subsidize management fees &/or pay the costs of investment due diligence

6.) Allow private investors to ‘buy-out’ the Government’s equity, usually within the 1st five years of fund operation, at cost + a bank interest rate of return

Yozma worked exceedingly well in Israel and a few industrial nations.[1] But results in China, Russia, Chile, and other emerging countries has not been so spectacular; local investors didn’t respond in the #s or volume of investments in the seed and early stage sector as expected and targeted by sponsoring governments.[2]

Hmmmm. Reality sets-in as staffers scramble for new solutions and a chair before the music stops. “Let’s try something different.”

When domestic capital does not change its risk behavior to seed/early stage tech, government staffers work vigorously to create a new class of investor—angels—since their risk behavior better matches the profile of entrepreneurial ventures. While angel investors are welcome in all countries, developing this community takes years to accomplish with multiple false starts and entrepreneurs seeking money now going unfunded.

“Hmmmm—let’s rethink what the initiatives should be.”

Plenty of money exists in the pocketbooks of local investors in emerging markets to finance start-ups for a start-up community to emerge. What’s required is the unlocking and mobilizing of local capital for investment in technology, 1st time entrepreneurs and early stage tech SMEs. Certainly encouraging a cloning strategy in the entrepreneurial community is one solution to unleashing local capital as the successes of Russian clonentrepreneurs proved.

Another solution is to think forward—design venture schemes which better match local investors’ behavior to risk and the mentoring of local investors in early stage tech investment. Include in this mentoring ‘show & tell’ sessions of other financing solutions: royalty based or technology performance financing schemes, i.e., capital invested in technology SMEs with investment returns generated from the cost savings and/or revenue enhancement earned by customers.

What else might you do, say with founders and management teams?

Organize a mentoring program; get them the mentors they need to ‘shape’ early stage tech business models to the risk attitudes & behaviors of local investors + ‘sell risk, then opportunity.’ Until investors can understand and ‘buy’ the risk in start-ups & early stage SMEs in the emerging markets, little capital will flow to them.

But what can you do if you seek to do something more ambitious, i.e., generate knowledge creation to disrupt industries and attract local investors for the needed finance? Deal flow funds are one solution to attack both needs.

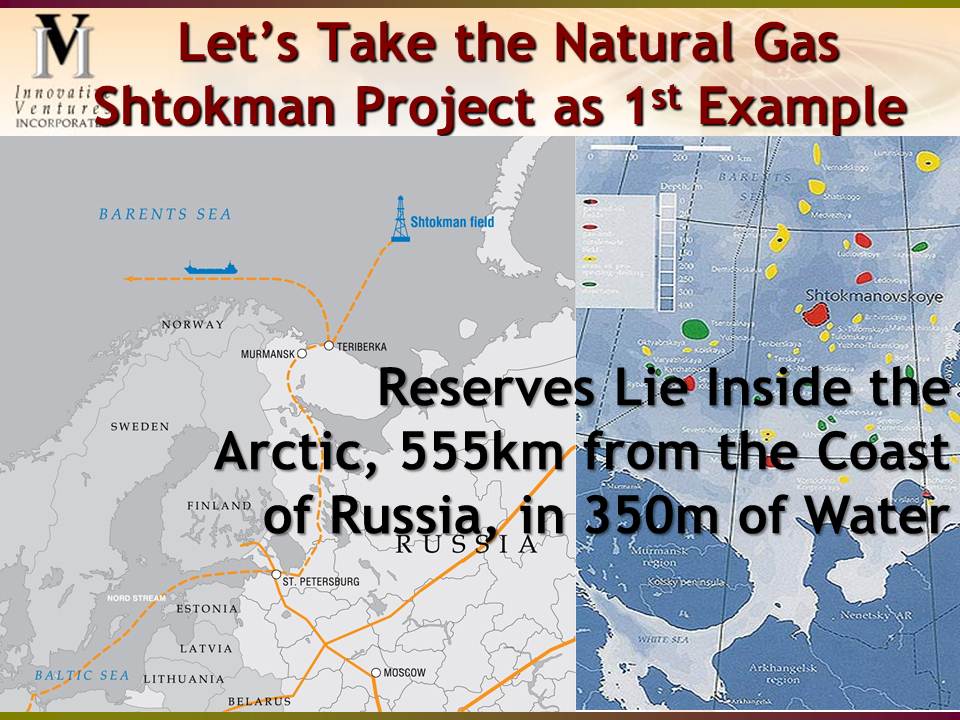

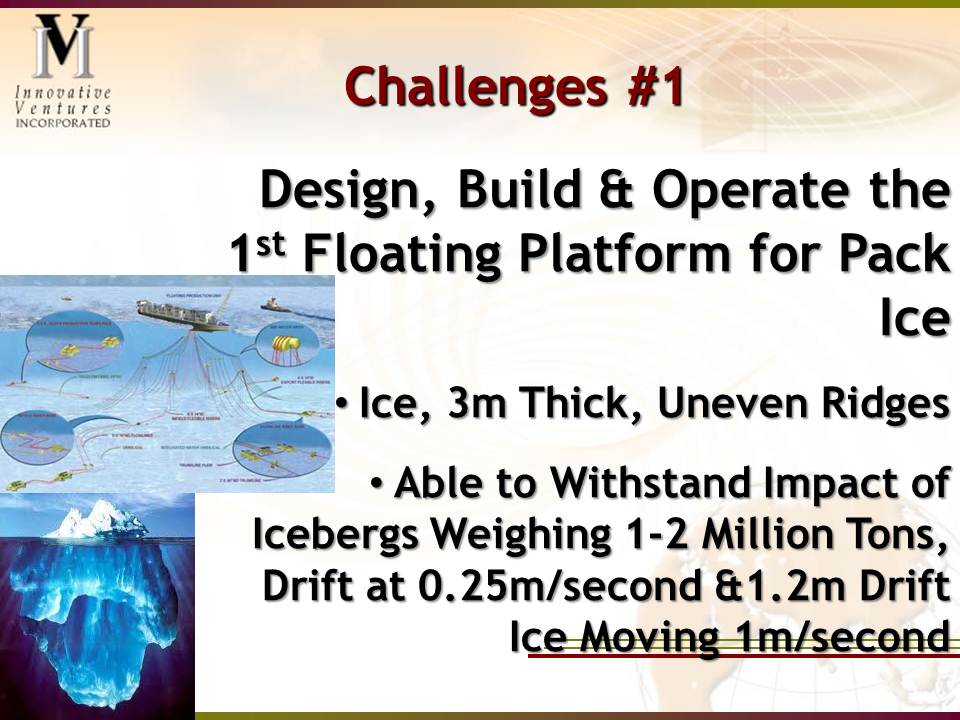

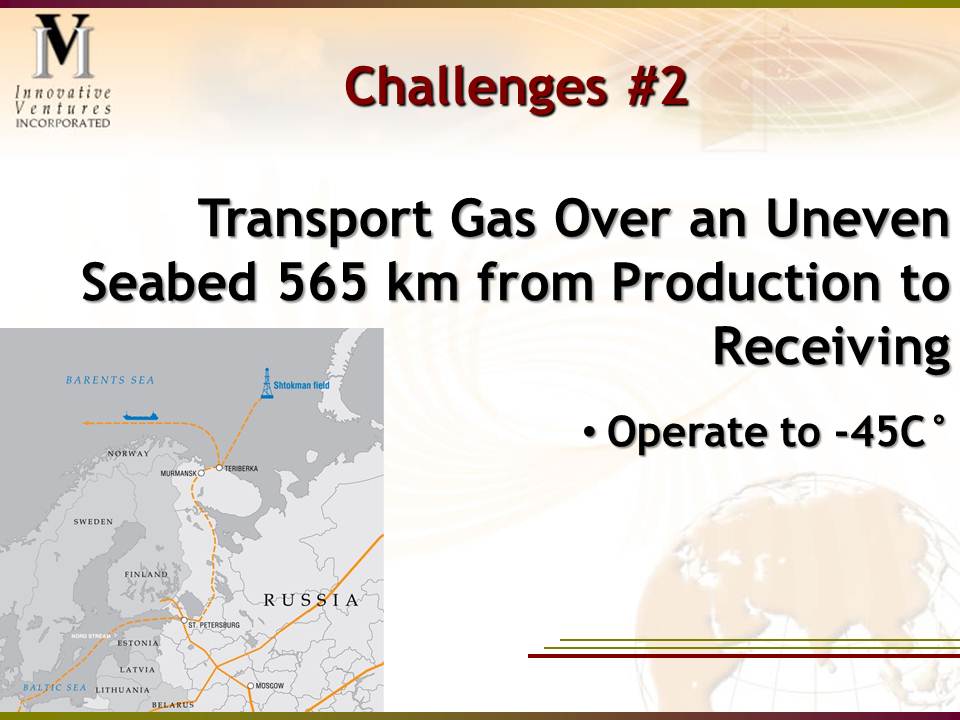

Deal flow funds finance entrepreneurs and SMEs executing to a single technology, product or service platform, technical challenges that require new thinking in science and engineering to accomplish. What might be an example of technical challenges in need of solutions? Take a look at these slides which tell this story.

A ‘deal flow’ fund finances technology development and commercialization. And in Russia for example, development of the Shtokman field is a national priority of the Russian Government, not only because of its wealth potential but also the promise of new economic prosperity to the Russia Far North. The linking of technology to a country’s national priority helps assure local financiers that innovators deploying the tech have a market and paying customers. It’s this matching of tech solutions to customers which harmonize the risk behavior of local investors to the risks of start-ups and early stage SMEs.

Concluding Remarks

Emerging markets face huge obstacles in finding talent, capital, knowledge, and yes, the business models which match the risk appetite of local investors.

Clones are one solution to spark the startup of a start-up community since they generate the revenues which local investors demand as a precondition for investment. As Clonentrepreneurs achieve success, it encourages others to try entrepreneurship too. Some are a bit more venturesome and launch improvements to models cloned from the West. Others do something different and inject their own notions of creativity by innovating new solutions layered on top of Western platforms like Russian beta-stage start-up ClipClock is doing to YouTube or IVI.ru is doing in the Russian video streaming industry.

Clones are one solution to spark the startup of a start-up community since they generate the revenues which local investors demand as a precondition for investment. As Clonentrepreneurs achieve success, it encourages others to try entrepreneurship too. Some are a bit more venturesome and launch improvements to models cloned from the West. Others do something different and inject their own notions of creativity by innovating new solutions layered on top of Western platforms like Russian beta-stage start-up ClipClock is doing to YouTube or IVI.ru is doing in the Russian video streaming industry.

A Future Blog Series: Mobilize Local Capital to Finance Your Dreams

This is one of the topics I mentored 80 entrepreneurs from 36 countries—at Singularity University, located in the heart of Silicon Valley. These entrepreneurs learned about exponential technologies to solve global challenges, and my job was to work with them—selecting ideas, developing and shaping business models to investors’ behavior to risk.

I was one of approximately 16 or so team project advisors selected from around the world to mentor these entrepreneurs at Singularity University, created by x-Prize Foundation founder/CEO Peter Diamandis and inventor, entrepreneur and futurist Ray Kurzweil.

Till then, be well and be lucky

[1] For explanation why Yozma worked great in Israel and not so well in emerging countries, see ‘The GoForward Plan to Scaling Up Innovation, page 4 (English). For my Russian readers, go to ‘The GoForward Plan to Scaling Up Innovation,’ by Thomas D. Nastas, June/July 2007, Russian edition, Harvard Business Review. Hungarian readers go to October 2007 ‘Scaling-Up the Innovation Ecosystem,’ Hungarian edition, Harvard Business Review; Sept. 200. Spanish readers go to ‘Innovation for Growth,’ Latin America edition, Harvard Business Review

[2] For explanation, how local investors in emerging market typically behave-invest, when managing Yozma-type schemes, see slides 50-68, ‘Bridging the Valley of Death,’ presentation of Thomas Nastas to staff of the World Bank & IFC, 29 November 2011

About Me

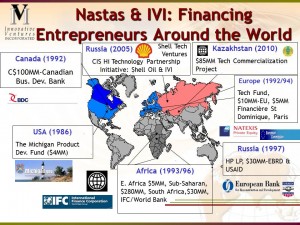

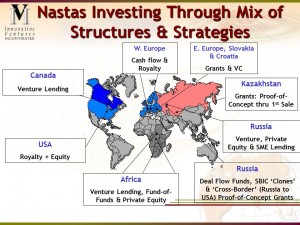

I am a venture and private equity investor since 1986, financing university tech in Michigan with liquidity events including Neogen (NEOG: NASDAQ), AISI Inc. (acquired by ESI, ESIO: NASDAQ, USA) & Personal Bibliographic Systems (acquired by Thompson Financial, NYSE: TRI) as examples. An entrepreneur myself, I left Michigan in 1992, created int’l and emerging market funds in Africa, Canada, Europe, Kazakhstan and Russia, for ROI & economic development, i.e., >$300 million invested to advance entrepreneurship, innovation and growth in int’l and emerging market countries. I am past/current Independent Director, Board of Directors of eighteen (18) companies over the past 25 years, USA & international enterprises.

I am a venture and private equity investor since 1986, financing university tech in Michigan with liquidity events including Neogen (NEOG: NASDAQ), AISI Inc. (acquired by ESI, ESIO: NASDAQ, USA) & Personal Bibliographic Systems (acquired by Thompson Financial, NYSE: TRI) as examples. An entrepreneur myself, I left Michigan in 1992, created int’l and emerging market funds in Africa, Canada, Europe, Kazakhstan and Russia, for ROI & economic development, i.e., >$300 million invested to advance entrepreneurship, innovation and growth in int’l and emerging market countries. I am past/current Independent Director, Board of Directors of eighteen (18) companies over the past 25 years, USA & international enterprises.

I can work with you in four ways.

1. As an investor advising LPs and GPs in your country for emerging market investment, create venture initiatives (+ raise capital). I invested my own capital + established and managed cash flow, venture, private equity and fund-of-funds as shown in the1st picture below. The 2nd picture shows the deal structures and strategies executed to localize money for investment in each country and to match local investors’ behavior to risk.

2. As an advisor to Governments & development finance institutions.

2. As an advisor to Governments & development finance institutions.

- Design & execute venture initiatives: My clients include Development Bank of Canada, European Commission, European Bank of Reconstruction & Development, IFC/World Bank, Russian Venture Company, Govts of Slovakia, Croatia and the US Govt’s USAID—create, startup, finance & execute:

- Venture capital funds

- Venture lending funds

- Private equity funds

- Royalty based & cash flow funds

- Fund-of-funds

- Design & execute grant schemes—to advance tech dev. thru commercialization: With six other directors, I manage the $85 million technology commercialization project in Kazakhstan, making grants to finance and advance science from proof-of-concept thru 1stcommercialization.

- We established the policies/procedures for grant investment, criteria, tender & selection process including all documentation for program execution

- Selected & committed $22.5 million to 21 development stage SMEs and R&D groups in 2011 & 2012, average grant ?$1MM

- I lead the creation of 1st technology commercialization office in Kazakhstan, to transfer Kazakhstan tech to market. I established strategy, programs, key performance metrics, deliverables and all tasks for commercialization & execution-budget is $2.8 million, staffing of four international experts + five Kazaks.

- Design & execute int’l—cross border tech transfer & commercialization initiatives: Conceive programs and connect—Russian Corporation of Nanotechnology (Rusnano)—& int’l organizations

- Created project to establish technology proof-of-concept tech dev. & commercialization program between Rusnano & tech transfer offices of US universities (e.g., Colorado, Utah & Michigan). I established the trust and confidence in the parties to negotiate & secure signed agreements

3. As an entrepreneur mentoring founders & entrepreneurs as an Independent Director, member of the Board of Directors or member of the Advisory Committee. I established legal entities, hired & managed staff in Africa, Canada, Europe, Kazakhstan and Russia, all costs of market entry and operation financed by me. Living, working and investing in these counties—paying the bills too—developed in me the experiences to counsel:

- Founders of mid-size companies, revenues to $100 million, solutions to integrate their firms into global markets, harmonize products/services & the organization for this global expansion, raise int’l capital and build the 2nd tier layer of management for execution

- Entrepreneurs of early stage companies, my contributions include conceive/negotiate partnerships for 1st commercialization, raise 2nd round VC financing, ‘shape’ business models to the risk profile and behavior of local money in the country, mentor/counsel management team in growth & development

My other contributions to global entrepreneurship:

- Mentored social entrepreneurs from 25 countries & five continents at the ‘Unreasonable Institute,’ Boulder, Colorado

- Mentored 80 entrepreneurs from 36 countries—technology to solve global challenges—at Singularity University (Silicon Valley), created by x-Prize Foundation founder Peter Diamandis and inventor, entrepreneur & futurist Ray Kurzweil

4. As a thought leader & advocate of VC, entrepreneurship and innovation to solve global challenges, I conceive and deliver keynote talks and Master Classes to engage stakeholders with the ability, interest and resources to finance technology commercialization and early stage venture capital. View my publictions which spread ideas—solutions to create more investment, innovation and entrepreneurship.

Let’s engage, how make an impact, make money and have fun. Contact me at Tom@IVIpe.com. Learn more at Scaling Up Innovation.

Links: Evolution of Runet (Russia Internet) & the Russia Tech Scene

Top 10 Web Start-up CEOs in Russia, 2011

Top 10 Russian Web Startups of 2011

Top 30 Russian Internet Companies (Forbes, 2011)

Top 10 Internet Entrepreneurs, 2009

Top 10 Internet CEOs in Russia

Top 10 Russian Venture Capital Internet Investors 2009

Top 10 Russian Web Startups, 2008

Top 10 Russian Web Apps & Sites, 2007

http://www.marchmontnews.com/Archive/News/18636.html